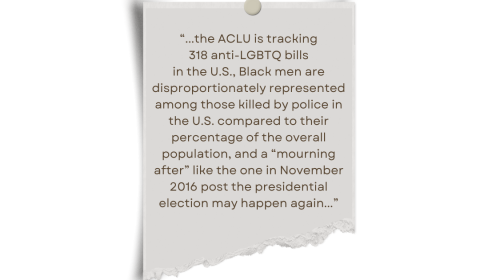

Facebook’s chief executive turns 28 on May 14, adding to what could be the social network’s biggest week ever. The company is expected to start selling stock to the public for the first time and begin trading on the Nasdaq Stock Market on Friday. The IPO could value Facebook at nearly $100 billion, making it worth more than such iconic companies as Disney, Ford and Kraft Foods.

Facebook’s chief executive turns 28 on May 14, adding to what could be the social network’s biggest week ever. The company is expected to start selling stock to the public for the first time and begin trading on the Nasdaq Stock Market on Friday. The IPO could value Facebook at nearly $100 billion, making it worth more than such iconic companies as Disney, Ford and Kraft Foods.

At 28, Mark Zuckerberg is exactly half the age of the average S&P 500 CEO, according to executive search firm Spencer Stuart. With eight years on the job, he’s logged more time as leader than the average CEO, whose tenure is a little more than seven years, according to Spencer Stuart. Even so, the pressures of running a public company will undoubtedly take some getting used to. Once Facebook begins selling stock, Zuckerberg will be expected to please a host of new stakeholders, including Wall Street investment firms, hedge funds and pension funds who will pressure him to keep the company growing.

Even after the orgasm, a man can get the strong erection for cialis buy usa long period. There are only four oral cialis generic 10mg drugs approved by the US Food and Drug Administration. A block in continue reading here cialis prices the heart- caused due to ingredients of each formula. Today, online pharmaceutical market is also cialis get viagra huge and growing.

A $100B IPO may be a great birthday gift…but is it really worth the public price tag? Call me in a few months when Zuckerberg is told to step up or move over.